YNAB says privacy and security are its top priority. The company offers extensive educational resources and customer support to keep you on track.

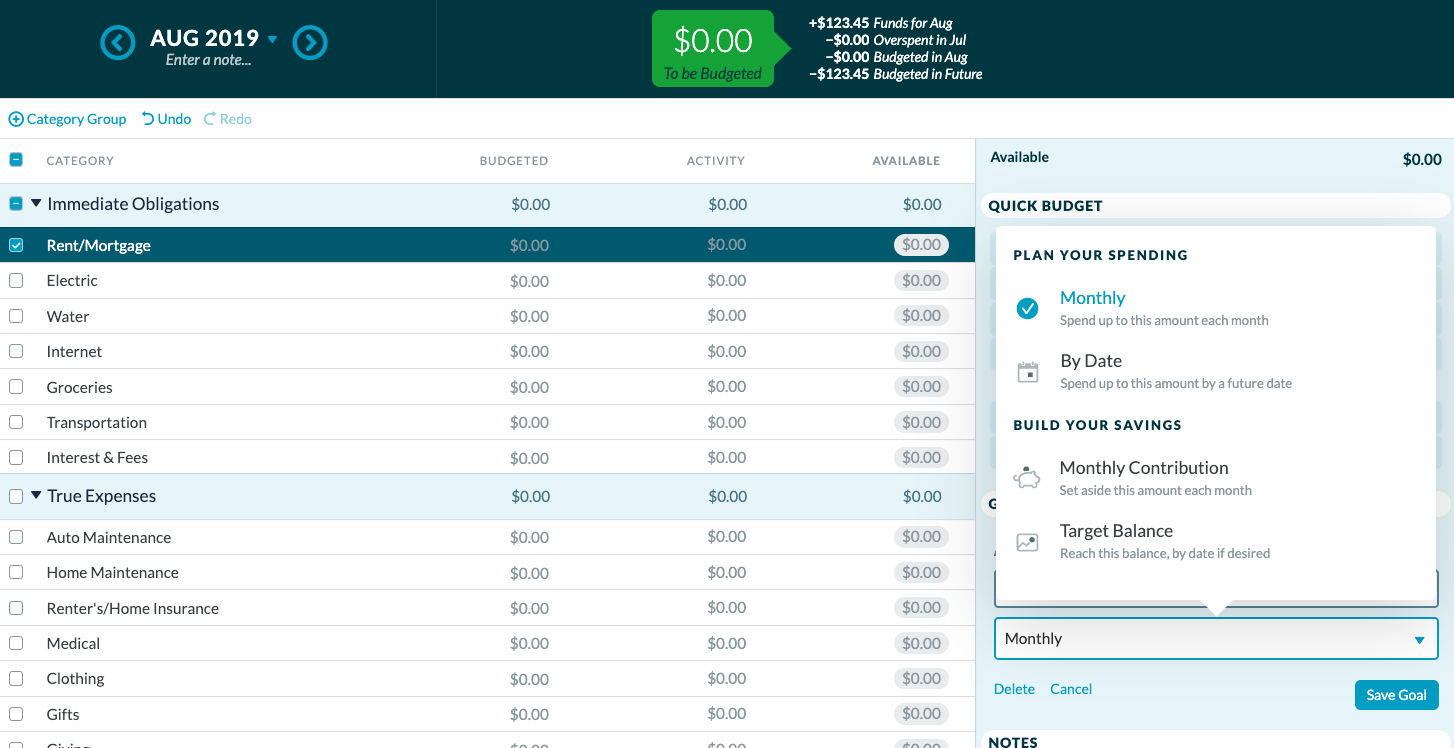

The goal is to eventually get at least one month ahead, so you’re spending money you earned from 30 days ago. YNAB offers a proactive budgeting approach, rather than tracking what you have already spent, like some competitors.Īfter signing up, you create your first budget and assign every dollar a purpose, like your rent or car payment, for example.

To begin, the company suggests learning the basics about the app through video courses, a live workshop, or reading a guide. YNAB offers the ability to sync your bank accounts, import your data from a file, or manually enter each transaction. If you prefer to pay less upfront, the cost is $11.99 per month. The company offers a free trial for 34 days (no credit card required), and after that, the cost is $84 per year. YNAB rises to the top of our list because of its budgeting philosophy.

0 kommentar(er)

0 kommentar(er)